Home Ownership

HOME APPLICATION MARCH 2024 ONLINE.pdf

Home Ownership: The “American Dream”

What is the Housing Choice Voucher Homeownership Option (HCVHO) Program? Quoting the H.U.D. federal Regulations, “The homeownership option is used to assist a family residing in a home purchased and owned by one or more members of the family.”

That simply means…HCV (Section 8) will make housing assistance payments towards a mortgage instead of rent!

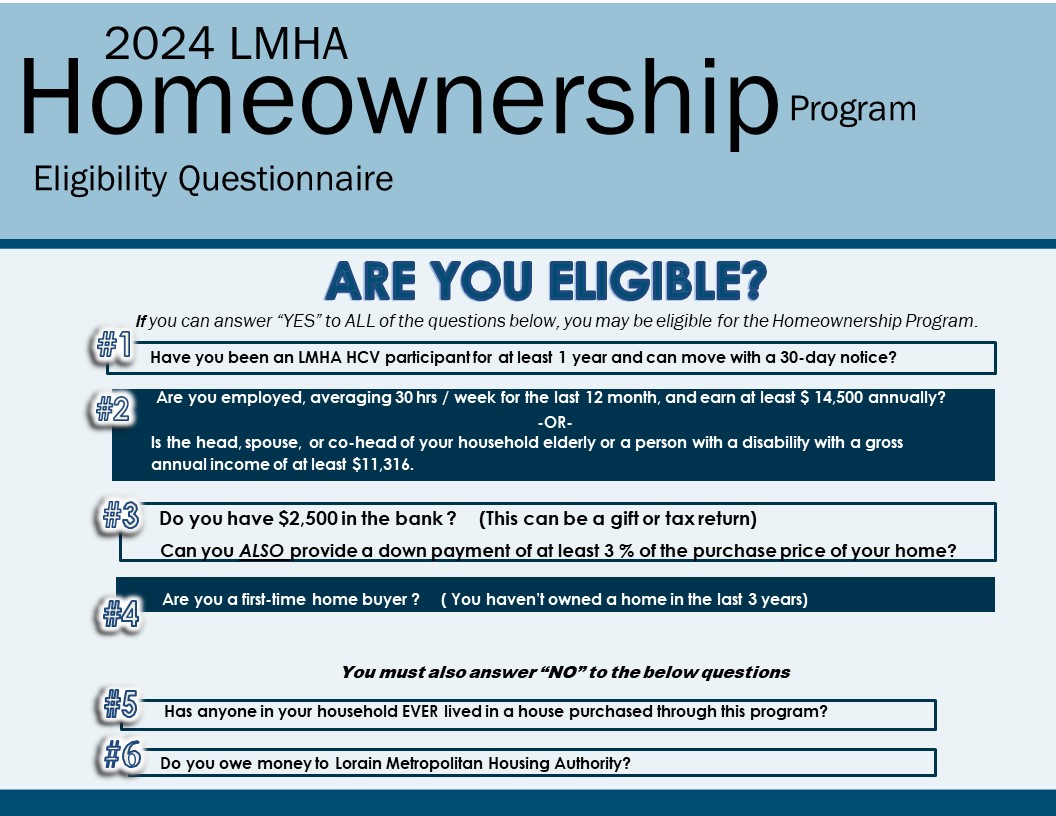

As you continue reading, you will see that every current Housing Choice Rental voucher Participant will not qualify for this program.

However, every current Housing Choice Rental Voucher Participant can work towards qualifying for this program.